Donation Receipt For Non Profit

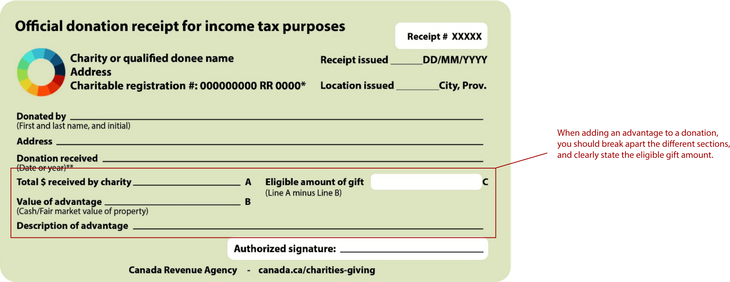

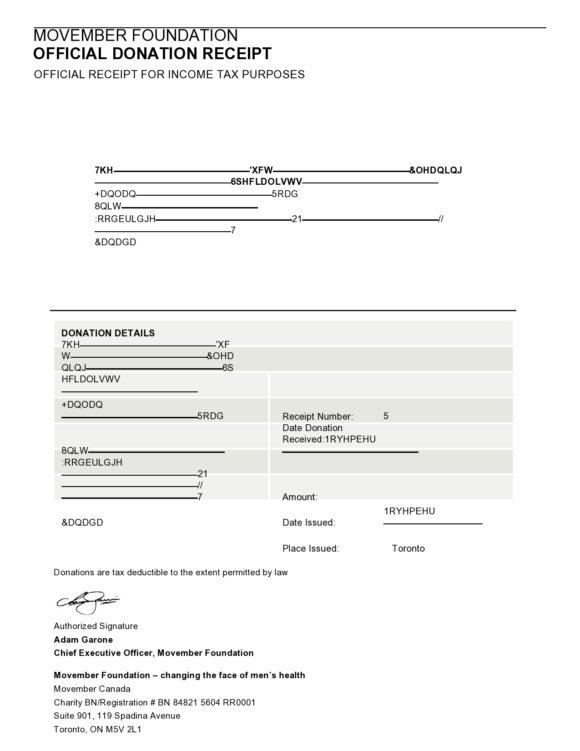

Charitable donation receipts contain any and all information regarding the gift donor name organization name gift amount gift type etc. Web Automating your donation processing can save your organization time and money.

Free Donation Receipt Templates Silent Partner Software

Donors use them as a confirmation that their gift was received and for charitable giving deductions when tax season rolls around.

. The 25000 donation rule simply states that for donations up to 25000 the donor can simply use a canceled check bank statement or other documentation for proof of the donation. Create Legal Documents Using Our Clear Step-By-Step Process. Web Donation tax receipts are required for any contribution of 250 or more to a 501c3 nonprofit.

Get Ready for Tax Season Deadline by Completing Any of Our Legal Forms Today. Table of Contents1 What to includeRead More Free Non Profit Donation Receipt Templates. The receipt details your contribution.

You must have your own donation receipt template if you are a member of an organization and you accept donations. Web A non profit donation receipt template is a document that serves as a proof that you made a contribution. Web Nonprofit donation receipts serve both donors and your nonprofit.

Build Receipts Other Transaction Records Free - Easy-to-Use Platform. Web When writing an automatic donation receipt for a 501c3 organization you should include. Any gift over 250 must be recognized with a receipt.

If the donation is higher than 250 the donor needs a written donation receipt from the nonprofit they donated to. Web The 25000 Rule For Donation Receipts. These notes serve as an acknowledgement that the gift monetary or non-monetary was received by the nonprofit.

Web Original Non Profit Donation Receipt Letter Template For Non Cash Source. In the US all types of registered 501 c 3 charitable organizations and registered 501 c non. Ad Answer Simple Questions to Make A General Receipt On Any Device In Minutes.

Web For monetary donations under 250 donors can use their bank record to claim their tax deductions. Ad Create Edit Sign Receipt Documents Online Today - Fast Easy Free. Our software can do this in a matter of seconds freeing up your staff to focus on other tasks.

Web A charitable donation receipt is a letter email message or receipt form notifying a donor that their gift has been received. Your organization can use donation receipts to aid in your accounting processes and to track a donors history with your organization. They would also have to track which charity they gave to on their own.

Personalization using merge tags which automatically pull a donors name organization info and transaction info into the receipt. In addition our software is available for a monthly subscription fee so you dont have to worry about. Our site shows when receipts are sent viewed by your customer and accepted or declined.

On average it takes an employee 2-5 minutes to create a receipt. A sincere thank you to your donor. Web Nonprofit donor receipts are written notes issued to a qualified donor after they have made a donation to an organization.

A specific description of how their gift will make an impact for this particular. A donation receipt is also required when a donor received goods or services in exchange for a single donation greater than. This includes both cash contributions as well as noncash gifts with an estimated value of 250 or.

A 501c3 Donation Receipt is a written document stating or acknowledging that a donation has been made and received from one party to another party an individual or.

Free Cash Donation Receipt Pdf Word Eforms

Donation Receipt Template Download Printable Pdf Templateroller

Nonprofit Donation Receipts Everything You Need To Know

30 Non Profit Donation Receipt Templates Pdf Word Printabletemplates

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

Why How And When To Issue Charitable Donation Receipts

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox